People fear what they do not understand. A good example is the purchase of a home. The average consumer knows very little about the home buying process. Between finding the right house, making sure it will not fall apart the day after you buy, and finding the best financing, it is no wonder so many people are afraid to buy homes.

Purchasing a home is one of the most important financial decisions you will ever make. For a first-time homebuyer, the decision to purchase can be daunting. It represents a major step since you and your family will potentially be assuming your largest responsibility. As with any major decision, it is important that everyone—especially first-time homebuyers—take full advantage of the information that’s available to more clearly understand the home buying process.

To prepare, do some research before beginning the search for your dream home. Here are 7 steps to get started:

Step 1: Before you start your house search, think carefully about what it will be like to be a homeowner. For most people, homeownership can be one of the most significant financial turning points in their lives. The advantages (tax benefits, pride of ownership, financial investment) far outweigh any drawbacks.

Step 2: Your credit history is one of the first things a lender will look at in making a decision on your loan. Request a copy of your credit report from Experian, Equifax and/or TransUnion, and review it carefully to be sure all the information is correct. If you find discrepancies, work with the credit agencies to resolve them. When you get pre-approved your mortgage professional will also be able to go over your credit report with you to ensure all information is correct.

Step 3: Saving for a down payment can be one of the biggest barriers to homeownership. Mortgage lenders recognize this dilemma, and some even offer loans with down payments as low as 3.5% or even 0% if you are a Veteran and have your certificate of eligibility.

Step 4: Keep in mind that most real estate agents represent the seller, not the buyer. But it is possible to work with a Realtor who is dedicated to YOUR interests as a homebuyer. By using a “buyer’s agent”, you have a real estate professional in your corner who can disclose things to you about the seller (or the home) that you’d never learn if you dealt only with the seller’s agent. Best of all, even though a buyer’s agent works for you (not the seller), you don’t pay their commission (the seller does)! If a Realtor won’t offer you a buyer agent agreement, look for another agent.

Step 5: Before you begin working with a Realtor, find a mortgage banker you can trust and ask to be pre-approved for a mortgage. Pre-approval is different from pre-qualification. Getting a pre-qualification letter is easy. You just call a mortgage broker or lender, provide some basic financial information, then wait a few minutes for the letter to come via fax or email. Getting a “pre-qual” from a website is just as easy. Enter some information, click “submit” and voilà.

A pre-approval letter, on the other hand, involves verification of the information. Rather than taking your word on faith, the lender will ask for documentation to confirm your employment, the source of your down payment and other aspects of your financial circumstances. Granted, a pre-approval is more time-consuming than a pre-qualification, but the additional due diligence is exactly why the pre-approval carries more weight.

Most lenders will provide this service free of charge. Getting Pre-approved will let you know exactly how much you can spend on a home BEFORE you start your search. A great mortgage professional will also help you figure out what is a comfortable monthly payment for you and your family. A pre-approval in hand also makes you a more attractive buyer when you’re ready to make an offer on a home. Home sellers are more likely to accept an offer from a buyer who can demonstrate the ability to secure financing.

Step 6: Many mortgage lenders, nonprofits, and even Realtors offer homebuyer education classes to prepare you for homeownership. Classes normally run about two hours and cover the basics of home buying. Some of the topics covered are how to apply for a loan, finding the right Realtor, making an offer on a home, and the advantages and responsibilities of homeownership. If you would like to know when the next class will be taking place feel free to contact me.

Step 7: A mortgage banker vs. financial institutions. Mortgage bankers only do mortgages so they are EXPERTS. They do not do car loans, savings account or any other type of lending. They know the mortgage guidelines the best and they want you to succeed! They have:

So, what is in it for you?

Obviously, there are real advantages to getting yourself out of the “trap” of paying rent. Now that you have seen some of the steps involved in achieving that goal, what is the best way to proceed?

Yes, you could wander out into the mortgage market on your own and start shopping, comparing and negotiating directly with banks. Even if you are working with a trusted real estate agent, you are still pretty much on your own when it comes to financing since most Realtors do not fully understand mortgages.

Keep in mind that that once you have signed a purchase agreement, you have to apply for a mortgage almost immediately. Is a day or two long enough for you to make a decision all by yourself that could affect you and your family for the next 30 years?

Dealing directly with a financial institution can add even more stress. Most banks like to “cherry pick” the easy clients that fit into standard off-the-shelf mortgage products. If your needs are slightly different, you may be turned down or end up paying a higher rate.

Why complicate and struggle through what should be one of life’s greatest pleasures? As your local mortgage banker, Iwould be happy to help you realize your dreams of homeownership and guide you throughout the process. By working with a true professional—someone who has specialized knowledge of home financing—you can get the best available mortgage and service available, and be confident you have made the right decision for today and the foreseeable future. The result: you’ll save thousands of dollars and take a big step toward future financial security!

Let me help you get started on the road to homeownership today.

Well, I hope I got you thinking. You probably still have some questions, and I would be happy to answer them. In fact, I would be pleased to sit down with you and do a detailed no-charge analysis of how much you will save by owning instead of renting.

Please give me a call while this is fresh in your mind and you are still excited about all the possibilities. Even if you are a little skeptical—which is only natural—a phone call cannot hurt. The worst that can happen is you will spend a few minutes learning (I will keep it brief because I know your time is precious). The best that can happen is you will get some peace of mind and end up saving yourself lots of money!

More and more people who are renters are now qualifying to become homeowners. Do not let fear or lack of knowledge stand in your way. My job is to educate and advise you. Call me today to take one step closer toward your dream of homeownership!

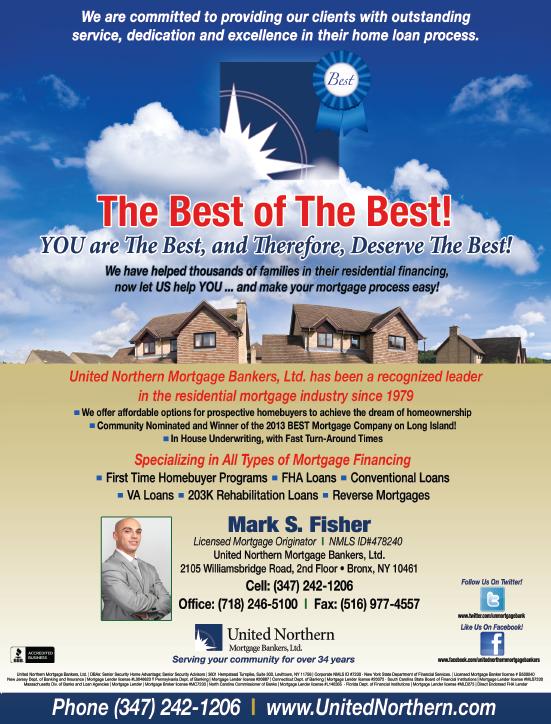

Mark Fisher

Tel.: 347-242-1206

E–mail: mfisher@unitednorthern.com

United Northern Mortgage Bankers, Ltd.

NMLS #478240

MarkFisherNYC.com

BronxHomeBuyer.com