President Xi does not need to get elected.

President Trump needs to get reelected. The stock markets will crash further if there is no trade deal with China and Trump will not get reelected. Therefore Trump must make a deal with China. It’s a syllogism.

The forecast: Trump will make a deal. If there is a deal, the stock markets will have found a bottom.

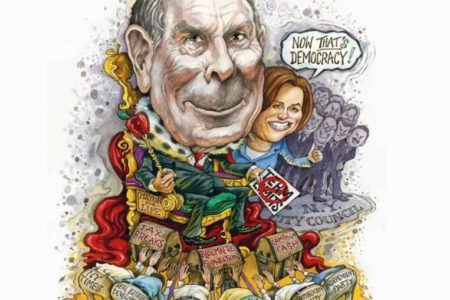

America the Ungovernable

The other major factor affecting the stock market, and hence Trump’s reelection, is the Fed. The Fed raised the Fed funds rate last month. That probably was a mistake. But the Fed had no choice because Trump had publicly demanded it not raise rates. The Fed must preserve its independence against political meddling. Chairman Powell gave an interview last week which was very reassuring to the markets. It is in Trump’s interest that when it comes to the Fed he keep his mouth shut. The markets trust Powell certainly more than Trump.

Meanwhile, the American president and the Congressional Democrats waste everyone’s time arguing about a wall. The American government shutdown continues—more than anything else a symbol of the erosion of American leadership. Trump now threatens to declare a national emergency and use it to build the wall. Abuse of Presidential power? Definitely. But the Democrats allowed Trump to use the national emergency excuse to impose all sorts of tariffs. Congress is supposed to have the power to tax under the constitution. The Democrats tolerated Trump’s abuse of national emergency decrees. And worse. Trump brags endlessly without contradiction from the Democrats about how his China tariffs are bringing in billions. But it is Americans who are paying those tariffs!

We Have Been Warned

For the past two years, this blog has been part of the chorus warning about the populist anti-globalist, anti-technology sentiments that have infected Western democracies. Trump is the number one offender but Brexit in Europe comes in as number two. Unfortunately, Trump’s populism comes with significant anti-China bias which has now infected the American government and media.

Things are getting serious. Friday’s super rally aside, the US stock market, having hit all-time highs in mid-2018, has basically turned into a mini-crash since then. When the American president tries to disrupt the incredibly efficient global supply chains that have developed since the end of WWII, the results can only be a disaster. Most of the stock markets around the world, especially that of China, have already hit bear market lows. I wrote in past blogs that the US market and the US economy could not keep rising while the rest of the world was in the dumps.

Now, we have gotten some serious warnings. The straight-talking CEOs of three major American world companies, Micron (MU), Federal Express (FDX) and Apple (AAPL) have issued forecasts that future business looks really bad. And they weren’t warning just about China. Council of Economic Advisors Chairman Kevin Hassett said we can expect more corporate earnings downgrades until the trade deal with China is finalized! He’s right of course but my reaction to hearing an Administration official say this publicly is: Did he really say this? Does this Administration have a clue about what they are doing to the global economy and the global stock markets? Last week it was Secretary Mnuchin’s ill-advised liquidity phone call to bank CEOs.

Friday’s unemployment report suggests that the US economy is still booming. We shall see. The unemployment numbers are not forecasts of the future. Rather the unemployment report is considered a lagging indicator. Other economic numbers like the US ISM report and the Chinese purchasing manager report were negative. The auto companies reported below-expectations December sales. In my opinion, the American trade and technology war with China and global supply chains have the potential to bring more stock market declines and a possible future recession. The stock markets will go down further if more CEO warnings are issued.

I am struck by glib optimism which up until now has been on parade on the various business networks. Various economists and strategists offer the same opinion: “China is going to grow at six percent this year. That’s not so bad.” Except there is reportedly at least one economist in Beijing in the Chinese economic underground who is reportedly calling for one percent Chinese real GDP growth in 2019. Or less. China is suffering from the US-led trade war and its own state-directed overheating and suboptimal investments. The Fed has raised US interest rates. I don’t see how China could possibly grow at an honest six percent in 2019. I think this dimmer view will rapidly become the new consensus.

China is hurting from the US trade war more than the US. The one person who can be happy over this is Peter Navarro who in his book Death by China has advocated making China poor. Navarro is Trump’s leading economic advisor and Trump’s economic Rasputin. Rasputin, of course, was the mad Russian mystic who advised the last Tsar. A stock market decline and even a US recession are unavoidable collateral damage for Navarro. We can only hope that this Rasputin, and his side-kick Robert Lighthizer, do not subvert the current US-China trade talks. Trump is going to have to overrule these people if he wants a China deal and he wants to be reelected.

And therefore he will make a deal. That is the most likely outcome. If that is the outcome, even as the world is inundated with bad current news, the stock markets will find a bottom.

No deal and the markets plunge further. No question these are very risky times for investors.

The US and China Must Step Off Path to Disaster

The above title is actually a quote from a South China Morning Post interview with noted Columbia University economist Jeffrey Sachs. And a view which I wholeheartedly endorse. It would seem that there is a special effort in the American government to make China into an enemy. Rationality and honesty are being swept aside. This effort is on its way to becoming a disaster.

The different treatments of Huawei CFO Meng Wanzhou and executives of HSBC (HSBC) and Standard Chartered (SCBFF) are striking. HSBC and Standard Chartered admitted violating US sanctions regarding Iran and were fined billions. But no executives went to jail or were even charged. Huawei, on the other hand, denies violating the Iranian sanctions. But its CFO found herself in jail at the US behest in Canada. (She is now out on bail.)

It should be obvious to any fair observer that this attack on Huawei is really a protectionist effort by the US to head off Chinese dominance in 5G. 5G is the coming technology in wireless communication. Huawei is way ahead of all competition in 5G and China has already heavily invested in this technology including setting up base stations all over the country. Ironically, Huawei’s biggest competitors in the 5G area are Samsung (SSNLF), Nokia (NOK) and Ericsson (ERIC)—all non-US companies. The US has never presented a shred of evidence that Huawei has acted as an intelligence gatherer for the Chinese government. The US attempt to bully its allies into boycotting Huawei products is mercantilist and dishonest.

Ironically, the only US company that could give the Chinese companies genuine competition on 5G infrastructure is Qualcomm (QCOM). But Qualcomm is mired in lawsuits with Apple and management turmoil. Broadcom (AVGO), led by no-nonsense CEO Hock Tan, made an offer to buy Qualcomm. Who knows? Maybe Hock Tan would have turned Qualcomm into a 5G infrastructure competitor. But alas Broadcom’s bid was rejected on the specious grounds that Broadcom wasn’t American enough.

Sax argues “that China and the US have every reason to cooperate. It would be insane and utterly self-destructive to do otherwise.” This seems so evident that it doesn’t need defending. But the herd mentality has taken over in the US. China is our enemy is the new mantra. Therefore: Chinese students in the US are spies (according to Florida Senator Marco Rubio whose rants on China border on the irrational), US visitors should take special care when visiting China (according to a directive just put out by the US State Department), China has stolen untold billions in US intellectual property (according to everyone), Chinese scholars must be restricted in their visits to the United States. And everyone knows—Made in China 2025, actually an overrated piece of Chinese government propaganda—constitutes a mortal threat to the US.

The growing enthusiasm for China is our enemy recalls the invasion of Iraq and the non-existent Iraqi weapons of mass destruction. The invasion turned out to be a disaster in terms of human lives, money spent and the total upsetting of the Middle East. It was one of the dumbest things the US has ever done. But the invasion was supported by wide margins by both houses of Congress. And was wholeheartedly embraced by the US media and public. The invasion was treated like a football game in which the TV audience cheered as the American military rolled over its third world opposition. Members of the media vied to get “embedded” with the troops and get a first-hand view of “shock and awe.”

Actually, history is full of examples of democracies making stupid decisions. A mood comes over a country and rationality and honesty get swept aside. The crowds cheered when Britain entered WWI. This was to be followed by the deaths of a million young British men and the beginning of the end of the British Empire. And then there was the Spanish-American War. In 1898, America was goaded by the print media into war with Spain based upon the sinking of the battleship Maine in Havana harbor. The sinking was blamed on Spain. It was only in 1976 that a special investigation sponsored by Admiral Hyman Rickover determined that the sinking was probably due to an accident on the ship. Senator Rubio and his fellow China-haters should remember the Maine.

In the end, global supply chains will remain and the current episode will be seen as an interruption of an irreversible trend of globalization and accelerating technology. Trump and his fellow anti-globalization populists, in my opinion, will be seen as an aberration, albeit a serious one. We can hope that the coming US-China talks have a positive outcome. In the long run, US and China must sit down and talk not just about trade but also about avoiding an arms race.